The Greatest Guide To Feie Calculator

The 6-Minute Rule for Feie Calculator

Table of ContentsSome Known Details About Feie Calculator Feie Calculator Can Be Fun For AnyoneThe 8-Minute Rule for Feie CalculatorLittle Known Questions About Feie Calculator.The Buzz on Feie Calculator

He sold his United state home to establish his intent to live abroad permanently and used for a Mexican residency visa with his partner to help meet the Bona Fide Residency Test. Neil directs out that purchasing property abroad can be challenging without very first experiencing the area."We'll most definitely be outside of that. Also if we return to the US for physician's appointments or service calls, I doubt we'll invest even more than thirty day in the US in any kind of offered 12-month duration." Neil emphasizes the value of strict monitoring of united state sees (American Expats). "It's something that individuals require to be truly thorough about," he claims, and suggests deportees to be careful of typical errors, such as overstaying in the U.S.

An Unbiased View of Feie Calculator

tax obligation commitments. "The reason united state taxation on around the world revenue is such a large bargain is since several people neglect they're still based on U.S. tax also after transferring." The united state is among minority countries that taxes its residents regardless of where they live, suggesting that also if a deportee has no revenue from united state

income tax return. "The Foreign Tax Credit rating permits people functioning in high-tax nations like the UK to counter their U.S. tax obligation responsibility by the quantity they've currently paid in tax obligations abroad," claims Lewis. This makes sure that expats are not exhausted two times on the very same earnings. Those in low- or no-tax countries, such as the UAE or Singapore, face additional difficulties.

The 30-Second Trick For Feie Calculator

Below are several of one of the most frequently asked questions about the FEIE and other exclusions The Foreign Earned Income Exclusion (FEIE) allows U.S. taxpayers to exclude as much as $130,000 of foreign-earned income from federal earnings tax, decreasing their U.S. tax obligation. To certify for FEIE, you have to fulfill either the Physical Presence Examination (330 days abroad) or the Authentic House Examination (confirm your primary house in an international country for an entire tax obligation year).

The Physical Presence Examination additionally needs U.S (FEIE calculator). taxpayers to have both an international income and an international tax obligation home.

The 6-Minute Rule for Feie Calculator

An income tax treaty in between the U.S. and one more nation can help stop double tax. While the Foreign Earned Revenue Exemption reduces gross income, a treaty may offer additional benefits for qualified taxpayers abroad. FBAR (Foreign Bank Account Report) is a called for declare U.S. people with over $10,000 in international financial accounts.

Eligibility for FEIE depends on conference certain residency or physical existence tests. He has over thirty years of experience and now specializes in CFO solutions, equity payment, copyright taxes, marijuana taxation and separation associated tax/financial planning issues. He is an expat based in Mexico.

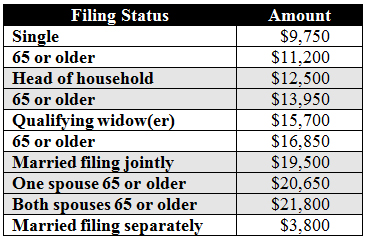

The international gained earnings exclusions, in some cases referred to as the Sec. 911 exemptions, omit tax on wages gained from working abroad. The exclusions consist of 2 components - an income exemption and a housing exemption. The adhering to Frequently asked questions talk about the benefit of the exemptions consisting of when both partners are deportees in a basic manner.

Feie Calculator for Beginners

The tax benefit excludes the income from tax obligation at lower tax obligation rates. Previously, the exemptions "came off the top" reducing revenue topic to tax at the top official source tax obligation rates.

These exclusions do not excuse the incomes from US taxation however simply provide a tax decrease. Keep in mind that a solitary individual functioning abroad for all of 2025 who gained concerning $145,000 without any other revenue will certainly have taxable income minimized to no - properly the exact same answer as being "tax obligation free." The exemptions are computed on an everyday basis.